Have you considered becoming a syndicator but aren’t sure where to begin with your offering memorandum (OM) real estate document?

As an experienced syndicator, I will walk you through the entire process.

I’ll explain what a real estate offering memorandum is, why it’s critical for attracting investors, and how to optimize every section. You’ll discover how to create an OM that builds trust and confidence.

Learn tips to create an interesting offering memorandum for investors and fuel syndication success! This guide will equip you to craft a compelling OM real estate document.

TL;DR:

- An offering memorandum (OM) is a legal document that provides detailed information about an investment in the commercial real estate industry.

- The OM is important for investors and sponsors because it provides transparency and disclosure, protects both parties and provides detailed information about the real estate deal.

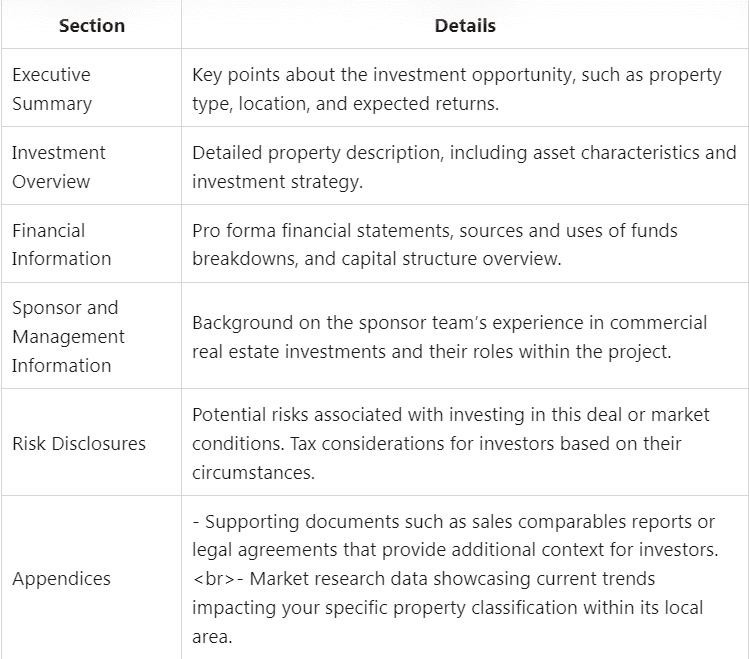

- This legal document includes the following sections: executive summary, investment overview, financial information, sponsor and management information, legal and risk disclosures, and appendices.

Definition of an Offering Memorandum

An offering memorandum (OM) and a private placement memorandum (PPM) are comprehensive legal documents providing detailed information about an investment opportunity in the commercial real estate industry. This document helps investors make informed decisions about investment opportunities.

The main difference between an offering memorandum and a private placement memorandum is its usage.

While both documents serve similar purposes, offering memorandums are typically used for raising capital from accredited investors through syndication or crowdfunding platforms.

In contrast, PPMs are used for raising funds privately from individual investors. This is my approach, and my experience as a hotel syndicator has been with PPM documents.

Legal Requirements for an Offering Memorandum

To meet securities regulations, your commercial real estate offering memorandum should contain required information and disclosures, including complete financial data, potential risks of investing in the opportunity presented, and investors’ consent.

Disclosures include accurate and complete financial projections, explaining risks associated with the investment opportunity, and obtaining proper consent from investors before accepting investments.

Purpose of an OM Real Estate

A commercial real estate OM provides transparency and disclosure about the syndication investment opportunity. Potential investors can better understand what they’re getting into before committing to funding. The document includes a property description, purchase price, financial analysis, floor plans, and market overview.

The real estate offering memorandum protects sponsors and investors by providing everyone with access to key information regarding the deal structure and expected returns on investment (ROI).

This transparency helps you build trust and credibility with investors, ultimately leading to successful commercial real estate industry syndications.

Contents of an Offering Memorandum

A commercial real estate OM should include the following sections:

Importance Of Offering Memorandum in Commercial Real Estate

Transparency And Disclosure

An offering memorandum real estate document provides all relevant information about the property, financial projections, risks, and management team is disclosed to prospective investors.

Protection for Investors and Sponsors

The real estate offering memorandum acts as a safeguard by outlining important legal disclaimers, risk factors associated with the investment opportunity, regulatory considerations, tax implications, etc., helping both parties understand their rights and obligations.

The Securities and Exchange Commission (SEC) requires that all offering memorandums comply with specific regulations to protect investors.

Information on the Investment Opportunity

The main goal of an offering memorandum is to provide investors with enough data to evaluate whether they want to participate in a particular commercial real estate investment. The offering memorandum should include the following:

- The property description includes location, size, zoning restrictions, floor plans, and market overview.

- An executive summary highlighting key points like property price, strategy, and objectives.

- The financial analysis section contains pro forma financial statements, sources and uses of funds, and capital structure.

- Sponsor and management information providing background on the team responsible for executing the investment strategy.

For more information on SEC regulations and private placement offerings, visit the SEC website.

Contents of Offering Memorandums

The commercial real estate OM typically includes the following sections:

Executive Summary: This summary presents critical information about the commercial real estate property, such as the property type, purchase price, and projected returns. The executive summary should provide a concise overview of the investment so readers can grasp what is contained in the remainder of the document.

Investment Overview: The investment overview dives deeper into details such as the description of the property or asset, investment strategy, and objectives. This investment summary provides investors insight into how their funds will be used in the commercial real estate deal and the expected return on investment.

Financial Information: In this part, you’ll find financial data such as pro forma financial statements, sources and uses of funds, and capital structure and ownership interests. The goal here is to give investors a transparent view of how their money will be allocated throughout various commercial real estate investment deal stages.

Sponsor and Management Information: This section highlights background information on real estate professionals involved in managing investors’ capital, including the background and experience of the sponsor and management team, as well as the roles and responsibilities of each member.

Investors need to know who they’re entrusting their money with, so this portion of the document helps build trust in the expertise of those managing the investment.

Legal and Risk Disclosures: This part outlines potential risks associated with investing in the opportunity, regulatory and tax considerations, and disclaimers and acknowledgments. These disclosures help protect sponsors and accredited investors by making sure everyone knows potential challenges before committing.

Appendices: The appendices contain supporting documents such as floor plans or legal agreements, market research reports, and due diligence materials. This additional information allows prospective investors to see the specific aspects of the deal, providing further insight into what makes it a good commercial real estate project for them to consider investing in.

Investors Review The OM

When investors review a real estate offering memorandum for real estate investments, they will perform due diligence, assess whether the investment aligns with their goals, and consult legal and tax advisors. This section will guide you through these steps.

Due Diligence

Investors will analyze the provided financial information, property description, market overview, and other critical points in the offering memorandum. They may request additional documents or ask questions about any unclear aspects.

They will likely research similar properties or sales comparables to provide valuable insights into the potential success of this real estate investment.

Investment Criteria

Potential investors will assess whether the commercial property deal is compatible with their individual and financial aspirations before committing resources.

Your proposed opportunity will be compared against other options and factors such as purchase price, similar properties, projected returns, risk levels, management team experience, property type/location, etc. This comparison helps investors make an informed decision based on what best suits their needs.

Legal and Tax Advice

No matter how attractive a prospective investment may seem, a potential investor should consult with legal and financial advisors.

These advisors can help identify potential risks associated with regulatory compliance issues or tax implications that might impact profitability. Additionally, SEC rules and regulations may apply to certain syndications, so the investor must understand these requirements before proceeding.

Wrap-up and My Experience with Offering Memorandums

To be a syndicator, you must work with a lawyer to create an offering memorandum real estate document to present to potential investors.

My experience with this document is that it’s created through a collaborative process with your attorney. You provide information such as details on the property, how much capital you need to raise, and how you want to structure distributions. Your lawyer creates the document, and you review it for accuracy.

This process can take a few months, so plan for this in your overall timeline and strategy.

Offering Memorandum FAQs

What is a Commercial Real Estate Offering Memorandum?

An offering memorandum is a document that provides detailed information about properties being marketed for sale. It includes property details such as location, size, use, financial performance, etc.

Real estate syndication software can help you manage investor communication, distribution calculations, and project-related details after purchasing a property. Commercial real estate software like this will help increase investor transparency and trust.

Is an offering memorandum legally binding?

Yes, an offering memorandum is a legally binding document, as it sets out the terms and conditions of the securities being offered for sale, including the rights and obligations of the issuer and the investors.

What are GPs and LPs in Real Estate?

GP (General Partner): This is the syndicator role. The GP manages and operates the investment project. GPs make key decisions, oversee daily operations, and typically earn a share of the profits in addition to fees.

LP (Limited Partner): LP is the investor role. LP invests capital in the project but generally has a passive role. They have limited involvement in management decisions and primarily seek returns on their investment.

Mike Stohler

Mike Stohler is the co-founder and managing partner of Gateway Private Equity Group, bringing over 20 years of experience in real estate investing. He has managed over 1500 apartment units, bought and sold complexes, and transitioned into hotel investing where he now syndicates projects in the US and internationally.